EBITDA Multiples by Industry: Valuation Insights for Investors

Investors like to use valuation multiples as a quick way to assess a company’s value and determine its investment prospects. However, it’s crucial to understand the proper applications and limitations of EBITDA multiples by industry to make informed investment decisions. Abrams Valuation Group, Inc. shares over 30 years of business valuation experience to break down EBITDA multiples by industry for investors.

What are EBITDA Multiples?

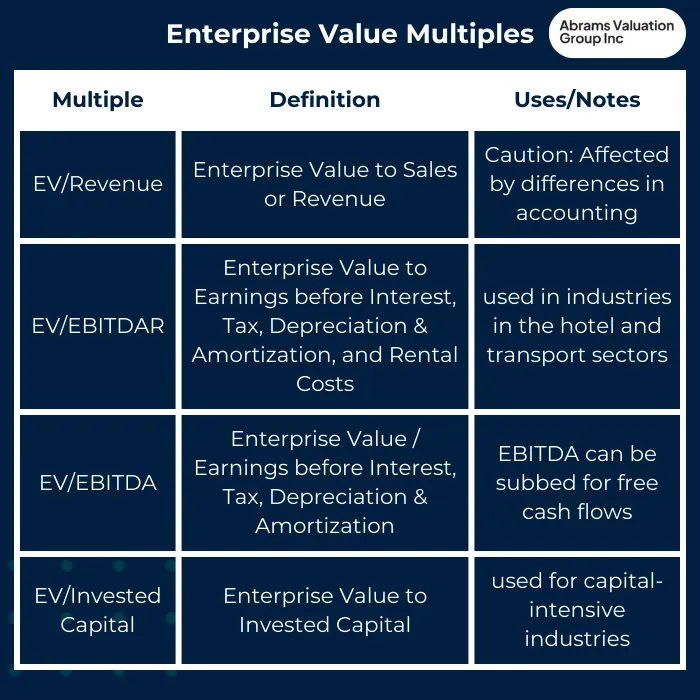

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. EBITDA is calculated as operating profit plus depreciation and amortization. This number is easily derived from a company’s financial statements and is a quick indicator of a company’s financial health and performance. EBITDA multiples are a series of financial ratios comparing various financial metrics to one another. They are calculated using Enterprise Value (EV) and EBITDA, in contrast to Equity Multiples, calculated using equity value drivers, such as price to earnings ratio. Learn more about the different types of valuation multiples here.

Because these multiples examine company earnings before taxes, EBITDA multiples allow investors to compare companies’ performance across different industries and tax brackets. That flexibility can help investors determine whether to invest in a larger or smaller firm. However, that same flexibility also takes companies’ financial performance out of industry context, which can be misleading.

EBITDA Multiples by Industry

EBITDA multiples vary significantly by industry, making it essential to evaluate industry-specific EBITDA multiples when comparing companies in different industries. Studying companies’ EBITDA in the context of their industry enables peer analysis and provides deeper insight into the company’s performance relative to other similar companies.

Different industries have different EBITDA norms, and it is therefore important to view them in an industry context. For example, the Consumer Electronics industry has the highest average EBITDA multiple, with the Solar industry closely following. At the other end of the spectrum, the Thermal Coal industry has the lowest average EBITDA multiple.

Factors Influencing EBITDA Multiples

Several factors can influence EBITDA multiples, including a company’s financial health, industry, and growth potential.

In general, industries with high growth potential, high margins, and low levels of competition tend to have higher EBITDA multiples. Industries with high barriers to entry, such as the aerospace industry, tend to have high EBITDA multiples because they are perceived as protected from new competitors, leading to higher profit margins. Additionally, larger, more established companies typically have higher EBITDA multiples than smaller firms.

Industries with high competition levels and industries that require significant capital expenditures, such as hospitality, tend to have lower EBITDA multiples. That is because high capital requirements usually leave lower profit margins.

Understanding what influences EBITDA multiples is crucial in understanding the meaning behind the number- a high multiple might look like an enticing investment on paper. However, when put in an industry and competitive market context, the company may not actually be performing as well as it may have seemed.

Applying EBITDA Multiples in Valuation

EBITDA multiples are useful for evaluating stocks or making investment portfolio decisions between comparable companies. EBITDA multiples are easy to derive from readily available financial statements, making them a quick and easy way to assess company value. However, EBITDA multiples by industry give a very limited view on the company’s value and have significant limitations.

While EBITDA multiples can be a useful tool to establish an initial base value, they do not give a comprehensive picture of the company’s performance and precise value. EBITDA does not give a direct value for the business, and is subject to limitations and potential errors. AVGI strongly encourages investors to engage a business valuation expert or qualified financial advisor before making strategic investment decisions. A comprehensive business valuation is crucial, particularly when contemplating mergers and acquisitions.

Limitations of EBITDA Multiples

EBITDA multiples have several key limitations, which means investors should not rely solely upon them to make investment decisions. Here are a few key limitations.

EBITDA multiples do not give a direct value for the business. They are subject to approximation based on peer metrics, and give an estimated base value to the company, not an exact valuation.

EBITDA multiples may not be suitable for valuing particular tangible or intangible assets that may be worth significantly more or less for a particular company than comparable peer companies. Often, a company’s intangible assets make up a decent portion of its worth, which is often the case with goodwill. EBITDA does not always represent the intangible asset value accurately.

EBITDA multiples may be inaccurate for companies with different consumer markets. Two electronics companies may look comparable on paper, but in real-world terms, one targets the wholesale market, while the other targets retail, resulting in completely distinct operating methods and income margins.

EBITDA multiples are not immediately comparable across public to private companies. EBITDAs for private company valuations may need adjusting because of financial reporting and accounting practice differences.

Best Practices for Using EBITDA Multiples

Investors still rely heavily on EBITDA multiples for assessing companies. Here are few best practices to keep in mind when using EBITDA multiples by industry for portfolio assessment.

Use industry-specific EBITDA multiples to ensure accurate valuation.

Consider multiple valuation methods, including revenue multiples and EBITDA margin, to provide a comprehensive valuation.

Adjust EBITDA multiples for company-specific factors, such as growth prospects, rising market competition, and outstanding goodwill or other intangible assets.

Use industry-specific EBITDA multiples to identify potential investment opportunities or undervalued companies.

Engage a business valuation expert for a precise company valuation if you are considering a business acquisition, merger, equity deal or significant investment.

Using EBITDA Multiples by Industry: In Conclusion

EBITDA multiples serve as a valuable tool for investors and analysts aiming to assess company value and financial performance. Grasping the nuances of industry-specific EBITDA multiples and the factors that influence them is crucial for achieving accurate valuations. By applying these multiples thoughtfully and acknowledging their limitations, investors and analysts can make more informed investment decisions. For those seeking a more precise business valuation, we encourage you to reach out to AVGI experts, who bring a wealth of valuation experience and insight to ensure the most accurate business valuation.