The Gift Tax Guide: Rules, Exemptions, & When to Get a Gift Tax Valuation

High net-worth individuals want to plan their estates strategically to pass on as much wealth as possible to heirs tax-free. Giving gifts during their lifetime is an excellent way to transfer wealth and assets to family, friends, and other beneficiaries. However, knowing gift tax rules is crucial to ensure the gifting remains tax-free. If gifting is approaching lifetime limits, it must be done strategically to avoid incurring heavy gift taxes. AVGI breaks down gift tax rules on gifting money to family and identifies when getting a professional gift tax valuation is worthwhile.

What is considered a gift for tax purposes?

The IRS defines a gift as “any transfer to an individual, either directly or indirectly, where full consideration (measured in money or money’s worth) is not received in return.”

This includes, but is not limited to, gifts of tangible assets:

- Cash

- Real Estate

- Cars, boats, and other vehicles

- Art and Jewelry

- Antiques and Collector’s Items

Gifts of intangible assets are also subject to gift tax for US citizens (and, in specific cases, non-US citizens as well). These can include, but are not limited to:

- Stocks or bonds

- Copyrights, Patents, and other Intellectual property

- Contracts

- Life insurance policies

How Gift Tax Works

Gift tax applies to any transfer in which the giver did not receive full compensation for the monetary value of the transfer, even if they did not intend the transfer as a gift.

This is an important point, as many taxpayers may be giving gifts without realizing it. If the gift, intentional or not, exceeds the annual gift tax exclusion, the giver is obligated to file a gift tax return form 709 that year (even if no taxes are due).

Who Pays Gift Tax?

If there is a gift tax obligation, the giver, not the recipient, is liable to pay the gift tax.

Does the Receiver of a Gift Pay Tax?

No. The giver has to pay the gift tax if there is any tax obligation.

When do you Pay Gift Tax?

If there is any gift tax obligation (for gifts that exceed the annual gift tax exclusion), the gift tax is not paid annually. Rather, the tax is levied on the giver’s estate after the giver’s death. The gift is not taxed now, but it increases the tax liability of the giver’s estate later.

Due to the many exemptions on gift taxes, only a small percentage of US taxpayers need to file a gift tax return, with an even smaller percentage actually needing to pay tax. In 2023, only 0.14% of decedents were required to pay estate and gift taxes—just 4000 of the estimated 2.8 million people who died that year.

Gift Taxes and Exclusions

There are several exclusions and exemptions for gift tax. Gifts that fall into the following four categories are exempt entirely from gift tax and have no limits:

Gifts exempt from the federal gift tax:

- Gifts to IRS-approved charities

- Gifts to your U.S. citizen spouse (see here if your spouse is not a US citizen)

- Direct payments to medical service providers on someone else’s behalf

- Direct payments to educational institutions on someone else’s behalf

- Donations to political organizations

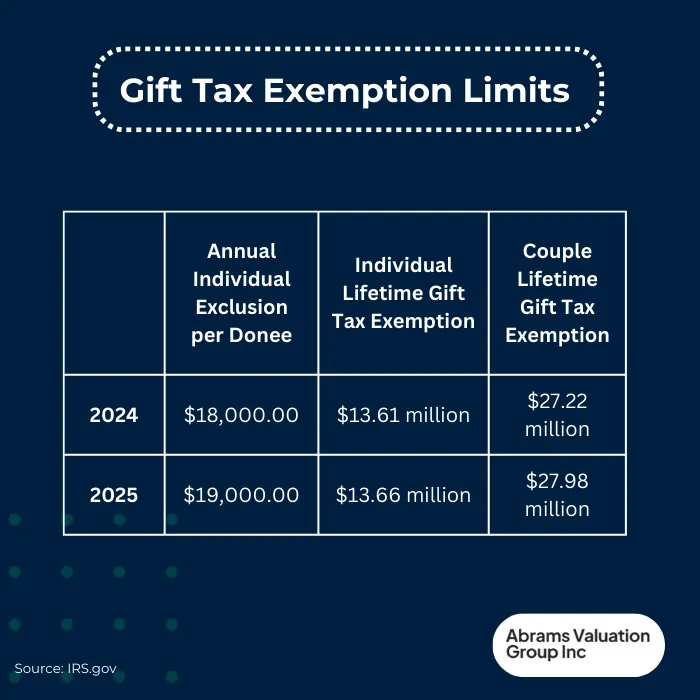

Gifts that do not fall into those five categories can still be exempt from gift tax if they meet the annual exclusion limits, which change yearly. Below, you can find a table with the gift tax limits for 2024 and 2025.

How the annual gift tax exclusion works

For the 2024 tax year, an individual can give up to $18,000 per year to any number of recipients without incurring gift tax. For married couples, this amount doubles to $36,000 per recipient per year, as they can split gifts. This means that a married couple can give $36,000 to multiple recipients without triggering gift tax.

Lifetime IRS Gift Tax Exemption (2024 & 2025)

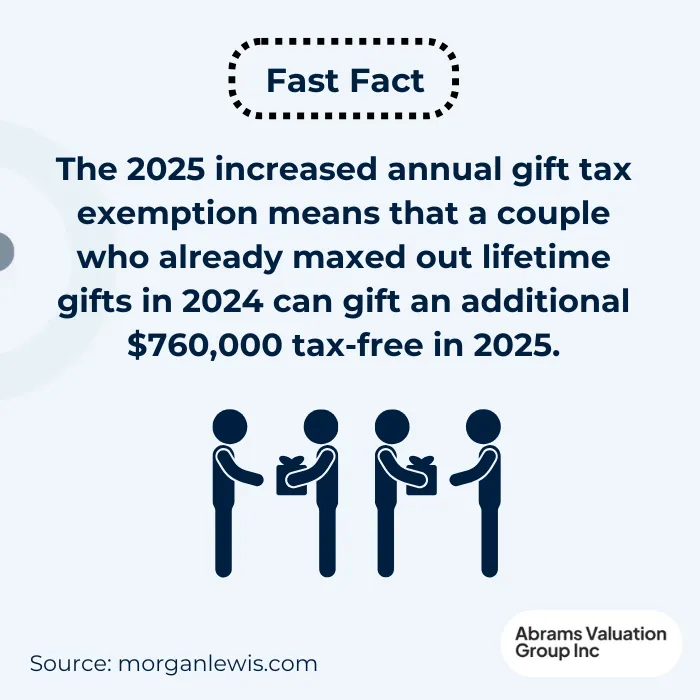

Additionally, individuals have a lifetime gift tax exemption limit, which is set at $13.61 million in 2024 and $13.99 million in 2025. For married couples, the combined exemption is $27.22 million for 2024 and $27.98 million for 2025. Any gift that exceeds the annual gift tax exclusion is deducted from the lifetime exemption.

However, in cases where gifts are likely to exceed these limits and be subject to gift taxes, obtaining a professional valuation from AVGI can be highly beneficial. A professional valuation can potentially save millions of dollars in gift tax by accurately assessing the value of the gifts.

IRS Gift Limit Example

If a married couple gives $40,000 to an individual in 2024, that is $4,000 beyond the $36,000 annual exclusion. Therefore, that $4,000 is deducted from the couple’s combined lifetime gift tax exemption of $27.22 million, leaving them with $27,216,000 for their lifetime exemption. Additionally, they will have to file a Form 709 gift tax return to report the taxable gift. (There is no joint gift tax return form, so either one spouse files the form claiming the gift, or the couple can split it and each file separate returns.)

When to Get a Gift Tax Valuation

There are several scenarios where it is highly advisable to get a professional valuation for gift tax purposes.

Before giving an expensive gift without a clearly defined fair market value

Cash gifts and gifts carrying a clear price tag, such as new cars, jewelry, clothing, etc., have a clearly defined value and are fairly straightforward to assess for tax purposes. However, if you are considering giving an expensive gift that does not have a clearly defined fair market value, getting a professional gift tax valuation is highly advisable. This is the case anytime you want to gift intangible assets such as stocks or intellectual property. This can also apply when gifting tangible assets that have a variable value, such as real estate, artwork, or antique items.

An appraisal allows you to get an impartial third-party opinion as to the value of the gift that you gave. This has several significant benefits:

- Clear documentation of the value of the gift at the time of giving

- Protects you from over-taxation

- Gives you a defensible basis in case of an audit

Although you may not be obligated to file a gift tax return (for example, if the gift’s FMV is under the annual exemption threshold), we usually advise clients to file it anyway. Filing the 709 form starts the three-year statute of limitations for the IRS to examine and potentially contest the return. If the IRS does not contest the return once three years have passed, they can no longer legally contest it. However, if you do not file a 709 form, the IRS can potentially contest the return at any point.

Before completing a transaction with family members or friends at full fair market value

If you sell real estate, artwork, or any other tangible or intangible asset to a family member or friend at full fair market price, that is not considered a gift. However, getting a professional gift tax valuation is still advisable. The IRS can contest the transaction, claiming that you undervalued the item that you sold to benefit the family member or friend, and it should, therefore, be considered a partial gift- potentially liable in gift tax. Pre-empting an audit with a valuation is a wise tax decision that can potentially save hundreds of hours of time and thousands of dollars of resources down the line.

When acting as the executor of an estate

The executor oversees the task of transferring the estate of the deceased to the descendants, ensuring the will is executed properly, and all taxes are paid. Gift taxes on gifts in excess of the lifetime exemption are due at the time of death when executing the estate. With the gift tax rate ranging from 18%-40%, it is highly advisable for the executor to get a professional appraisal of the estate to ensure the estate fulfills its tax obligation while avoiding paying too much tax.

Numerous other cases can benefit tremendously from an impartial third-party appraisal. Here, we have highlighted 3 common cases where taxpayers are often unaware they could use a valuation. Not sure if you need or could benefit from a valuation for gift tax purposes? Call us, and our expert team at Abrams Valuation Group, Inc. will be happy to help you define your valuation needs.

Book a 30-minute call (zero commitment)

Gifting large sums of money to family

There are several ways to strategically avoid over-taxation when planning large gifts of money to family members. This is a topic to discuss in detail with a tax professional, who can help you build an optimal tax strategy. Getting a professional valuation may also be beneficial in this scenario. Our gift tax experts at Abrams Valuation Group, Inc. are happy to help you determine if you need a valuation or refer you elsewhere if another professional might be a better fit for your needs. Give us a call today to start your gift tax journey on the right foot.

FAQs about Gift Tax

How does gift tax relate to estate tax?

The gift tax and estate tax are closely related in the realm of taxation in the United States. Both taxes are part of the federal transfer tax system and share a unified lifetime exemption. The gift tax applies to transfers of property by one individual to another while receiving nothing, or less than full value, in return. In contrast, the estate tax is a tax on the right to transfer property at death. Both taxes share a unified lifetime exemption, which means that any portion of the exemption used during life to avoid gift tax reduces the amount that can be used to avoid estate tax. Both estate and gift tax scenarios can benefit from a professional valuation to avoid over taxation and mitigate the risk of IRS audit. Professional valuation can help ensure that the fair market value of assets being transferred is accurately determined, thereby preventing overpayment of taxes. Moreover, in the event of an IRS audit, having a professional valuation can provide crucial support and documentation for the valuation of assets, minimizing the risk of penalties and additional taxes. In conclusion, understanding the relationship between gift tax and estate tax is crucial for effective estate planning, and seeking professional valuation services can help mitigate tax liabilities and ensure compliance with IRS regulations.

How much can you give tax-free?

That depends on how you want to structure your gift. An individual or couple can give an unlimited number of recipients gifts up to the federal limits for that tax year without incurring gift tax or needing to file a gift tax return. Theoretically, you can give as much as you want tax-free if you structure it correctly. The limits change based on the tax year, as the limits are adjusted yearly for inflation and other factors.

What are the gift tax rates, and when do they kick in?

Gift tax rates range from 18 and kick in as soon as a gift that exceeds both the annual exclusion and the giver has exceeded their lifetime exclusion as well. The gift tax rates are gradual and only the highest bracket is taxed at 40%