Business Risk Management: How Risk Impacts Value

Risk management is a crucial aspect of business operations that involves identifying, assessing, and mitigating potential risks that could impact an organization’s objectives. Risk can significantly impact the value of a business, especially if it is left unmanaged and out of proportion. Risks can influence investor confidence, financial stability, and overall market perception, negatively affecting the business from multiple fronts. Abrams Valuation Group, Inc. explores the impact of risk on value and how effective business risk management strategies can counterbalance those effects.

Understanding Business Risk

Business risks can be categorized into 4 main types, including strategic risks, operational risks, financial risks, and reputational risks. Understanding these different types is essential for developing effective risk management strategies that help mitigate potential threats. Business risk management involves the processes of identifying, assessing, and prioritizing risks to determine the most effective mitigation approaches. Central to this process are risk analysis and assessment, which enable organizations to evaluate and address potential risks systematically. Tools such as a risk register are commonly used to document, assess, prioritize, and monitor risk mitigation efforts, ensuring that organizations maintain an ongoing awareness and control over their risk landscape.

Risk Management Fundamentals

Risk management fundamentals encompass several key steps: risk identification, risk assessment, risk mitigation, and risk monitoring. Risk identification involves recognizing potential risks that could impact an organization’s objectives. Following this, risk assessment evaluates the likelihood and potential impact of these identified risks, often utilizing tools such as risk matrices to prioritize them effectively.

Risk mitigation then focuses on implementing strategies to reduce or eliminate risks, including approaches like risk avoidance, risk transfer, and risk reduction. Finally, risk monitoring is an ongoing process of continuously tracking and evaluating risks to ensure that mitigation strategies remain effective and adapt to any changes in the risk landscape. Together, these fundamentals form the foundation of a robust risk management process that supports informed decision-making and helps protect the organization’s objectives from various potential threats.

Operational Risk Management

Operational risk management involves identifying, assessing, and mitigating risks associated with an organization’s operational activities, which can include risks related to people, processes, technology, and external events. Effective management of these risks requires a thorough understanding of the organization’s operations and the potential threats they face. Strategies for operational risk management typically encompass risk avoidance, risk transfer, and risk reduction, alongside implementing controls and procedures designed to minimize risk exposure. A critical component within this domain is cybersecurity risk management, as cyber threats pose significant risks to an organization’s operations and reputation, necessitating robust protective measures to safeguard business continuity and maintain stakeholder trust.

Risk Analysis and Assessment

Risk analysis and assessment involve evaluating the likelihood and potential impact of identified risks using both quantitative and qualitative methods, such as risk matrices and decision trees. This process includes assessing the potential consequences of a risk event, which may encompass financial losses, reputational damage, and other negative outcomes. Additionally, risk assessment evaluates the probability and potential frequency of occurrence of these events. Tools like the risk assessment matrix are commonly used to prioritize risks based on their likelihood and potential impact, enabling organizations to address and manage their risk landscape systematically.

Decision Making and Risk

Decision making and risk are closely linked, as decisions can significantly impact an organization’s risk profile. Effective decision making involves evaluating potential risks and opportunities to make informed choices based on a thorough risk-reward analysis. This tool helps assess the potential risks and rewards associated with each decision, including possible financial losses, reputational damage, and other negative outcomes. A well-established risk management framework is essential to support this process, providing a structured approach for evaluating and mitigating risks systematically, thereby enhancing the quality and confidence of organizational decisions.

Implementing Risk Management

Implementing risk management involves putting risk management strategies and plans into action, which requires a thorough understanding of an organization’s risk profile and the potential risks it faces. This process includes allocating necessary resources such as time, money, and personnel to support risk management activities effectively. Establishing dedicated risk management teams is essential to oversee and coordinate the implementation of these strategies and plans. Additionally, purchasing insurance is a common and vital risk management strategy, providing financial protection against potential risks and helping to safeguard the organization’s stability.

Impact of Risk and Risk Management on Business Valuation

Risk plays a significant role in determining a business’s valuation. Companies facing higher levels of risk—whether due to unstable cash flows, regulatory uncertainties, or operational challenges—often experience lower valuations because investors and buyers perceive them as less predictable and more vulnerable to adverse events. Effective risk management can mitigate these concerns by demonstrating that a business has strategies in place to identify, assess, and control risks, thereby enhancing confidence in its long-term stability and profitability.

For instance, a technology startup operating in a rapidly evolving regulatory environment may face substantial legal risks associated with data privacy laws. This uncertainty can make its future cash flows unpredictable, leading to a discounted valuation compared to a competitor with robust compliance programs and strong risk management practices. Similarly, a manufacturing firm exposed to supply chain disruptions due to geopolitical issues or natural disasters might see its valuation impacted negatively if it lacks contingency plans or risk mitigation strategies.

On the other hand, businesses that proactively manage strategic risks, such as market competition or financial uncertainty, tend to enjoy more stable cash flows and a clearer path to achieving business objectives. This stability often translates into higher valuations as investors value predictability and resilience. For instance, a financial institution with comprehensive cybersecurity risk management and insurance coverage may be viewed as a safer investment, justifying a premium valuation despite operating in a high-risk industry.

In summary, risk factors and the effectiveness of risk management directly influence a company’s reputation, operational continuity, and financial performance—all critical components that investors consider when assessing business value. Companies that integrate strong risk management strategies into their business environment are better positioned to maintain or increase their valuation by reducing uncertainty and demonstrating control over numerous business practices.

Risk Management Solutions

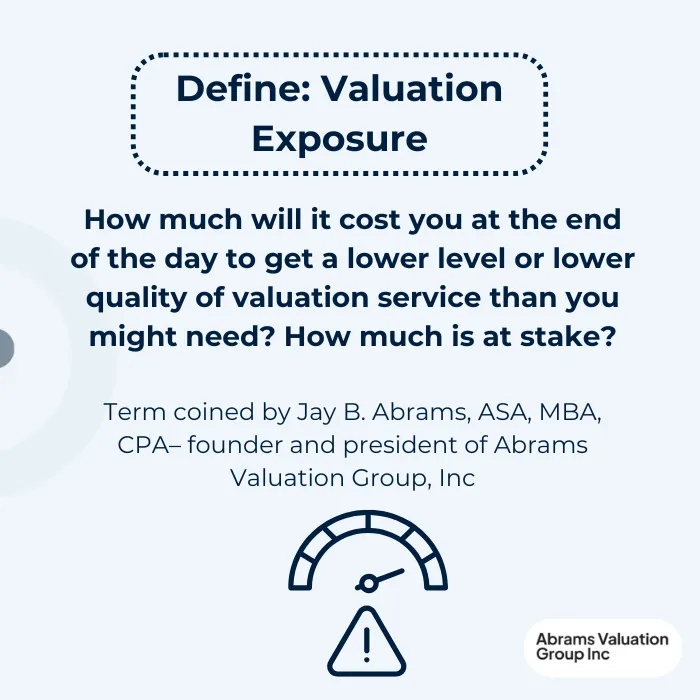

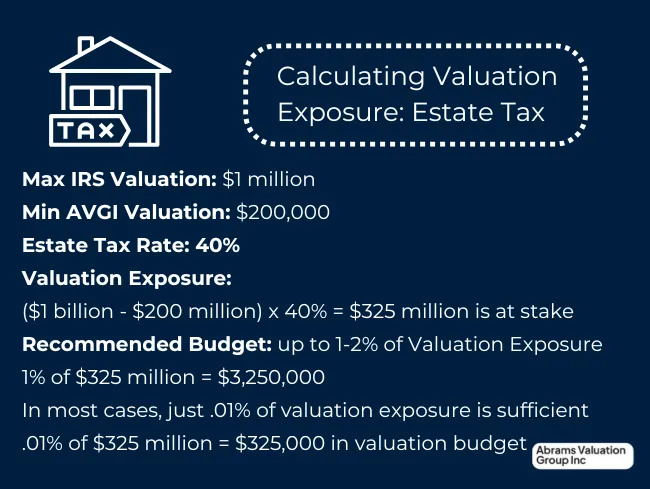

Risk management solutions encompass a range of strategies, including risk avoidance, risk transfer, and risk reduction, all aimed at identifying, assessing, and mitigating potential risks effectively. These solutions often involve implementing robust controls and procedures such as cybersecurity measures and business continuity plans to safeguard operations. Partnering with an insurance company can also provide essential financial protection against unforeseen risks. Additionally, advancements in artificial intelligence offer valuable support in risk identification and mitigation efforts. For businesses seeking to minimize their risk of valuation exposure, obtaining an accurate business valuation is crucial. Contact Abrams Valuation Group, Inc. (AVGI) today to ensure your business valuation reflects a comprehensive understanding of your risk landscape and supports your strategic decision-making.